stop on quote versus stop limit on quote

Stop quote orders are the same as stop orders but have been renamed by Merrill Edge in 2013 due to a FINRA rule change. A trader who wants to purchase or sell the stock as quickly as possible would place a market order which would in most cases be executed immediately at or near the stocks current price of 139 white line--provided that the market.

Stop Wishing Start Doing Motivational Quotes Quotes For Shirts Motivation Shirt T Shirts With Sayings

That means there are two specified prices.

. Using the stop-limit order your order is still triggered but doesnt execute unless the price rallies and hits your limit price of 95. Now lets break down the stop order in limit order vs stop order. The price you specified is reached or better.

For example a sell stop limit order with a stop price of 300 may have a limit price of 250. Join Kevin Horner to learn how each works. A Stop Price and a Limit Price.

For example if the trader in the previous scenario enters a stop-limit order at 25 with a limit of 2450 the order triggers when the price. For a retail trader like yourself theres no practical benefit to stop limits. A stop-limit order is implemented when the price of stocks reaches a specified point.

A Brief Guide For You. Once the shares reach 105 the stop order will execute and trigger the limit order. When you pass the trigger price the order goes in as a limit order.

So if ADA hits 230 and then drops to 229 it will not sell. When the stop price is triggered the limit order is sent to the. In this example the last trade price was roughly 139.

While trading it is essential to decide your orders wisely. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. The stop price and the limit price for a stop-limit order do not have to be the same price.

At this point the stop order becomes a market order and is executed. In our first example you were sold out at 90 because once the stop was triggered it became a market order and executed at the next available price. Stop limit orders are slightly more complicated.

The stock is volatile so you enter a stop price of 105 and a limit price of 110. Think of the stop as a trigger that will initiate the purchasesale and the limit as a condition. When it comes to managing risk stop orders and stop-limit orders are both useful tools but they arent the same.

Buy stop orders and sell stop orders. Stop orders are of two types. When you pass the trigger price order goes in as a standard limit order.

A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price. In this article well go over why Merrill Edge decided to rename their stop order and stop limit order to. A stop limit order is an order to buy or sell a specified quantity of an asset only if and when the stop price is reached and then only at or better than a specified limit price.

Investors and traders must analyze and observe the market before placing an order. Stop on Quote vs. Set a sudden plummet threshold with a Stop Stop on Quote price at lets say 8 20 down from todays high and the total gain and expect it to sell at market value when it hits 8 which should be.

A limit order will only ever be filled at the specified price or better. Enter a max sell amount. The stop price and the limit price.

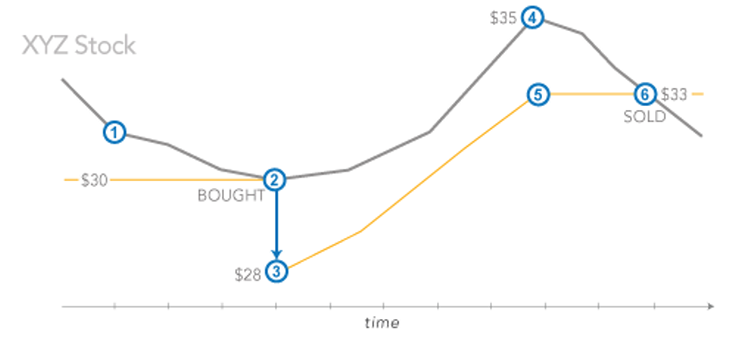

A stop price that executes sell order. The limit order will fill as long as the shares stay below 110. The above chart illustrates the use of market orders versus limit orders.

If the market reaches or goes through the Stop Price your order becomes a Limit Order. It enables an investor to have some downside. A stop-limit order holds a limit on the price which will trigger trade execution.

In this case it works well. Just use stop orders. It is equally essential for the trader to understand the types and differences.

Account holders will set two prices with a stop limit order. A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop price. Stop on quote vs stop limit on quote Stop-Limit-On-Quote Order.

A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. If it jumps up 245 it will then have a new price of 24019 that will be the limit sell price and you would have gotten a. If you want 100 shares the order will begin filling at 105 but will stop if the stock quickly shoots over 110.

It is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far. A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks. Also called a stop-loss order stop orders are used to buy or sell once the price moves past a certain point.

When a sell stop order triggers the market order is transmitted and you will pay the prevailing bid price in the market when received. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better. Rather than becoming a simple sell order the sell order turns into a limit order executing only at and above the limit price.

To place a Stop-Limit order you enter two prices. So once ADA hits 230 it will put a limit sell order that will trail the highest price by 2. A buy or sell stop quote on Merrill Edge will be executed once the market price hits the specified stop quote level.

Enter a limit price. Stop on quote orders can. Lets say a security is currently trading at 3000.

Set the sale as Limit and set the price to lets say 955 then pay attention to the marketstock to ensure it will hit that price. It enables an investor to have some downside. October 13 2021 by Arihant Chhajer.

This makes stop-limit orders even better.

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov

Limit Order Vs Stop Order Difference And Comparison Diffen

Stop Vs Limit Orders What Are The Types Of Orders In Trading

:max_bytes(150000):strip_icc()/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-3e4697527ad041809b1528ed6d5e0fa2.jpg)

Trailing Stop Stop Loss Combo Leads To Winning Trades

You Gain Strength Courage And Confidence By Every Experience In Which You Really Stop To Look Fear In The Face Yo Fear Quotes Overcoming Quotes Doubt Quotes

Stop Loss Vs Stop Limit Order What S The Difference

What Is A Conditional Order Fidelity

Age Is No Barrier It S A Limitation You Put On Your Mind

Limit Order Vs Stop Order Difference And Comparison Diffen

65 No More Love Quotes About Giving Up On A Relationship

Potentially Protect A Stock Position Against A Market Drop Learn More

Potentially Protect A Stock Position Against A Market Drop Learn More

If You Are A Giver Please Know Your Limits Because The Takers Don T Have Any

Trading Up Close Stop And Stop Limit Orders Youtube

One Day Your Heart Will Stop Beating

The Best Quotes To Inspire Positive Changes In Your Life Jill Conyers